Often covered under a commercial combined policy, here at HWH Insurance Brokers we recognise the importance of fully understanding your Manufacturing or Wholesaler business, the sector, and your customers, so we can tailor the insurance cover to mitigate against many of the risks your business faces.

Many manufactures could be working on a bespoke contract with high levels of work in progress and raw material expenditure many months before raising an invoice. Wholesalers could be exporting to high risk countries across the world where the stock needs to be sent. Both could be dealing with high risk customers on credit terms.

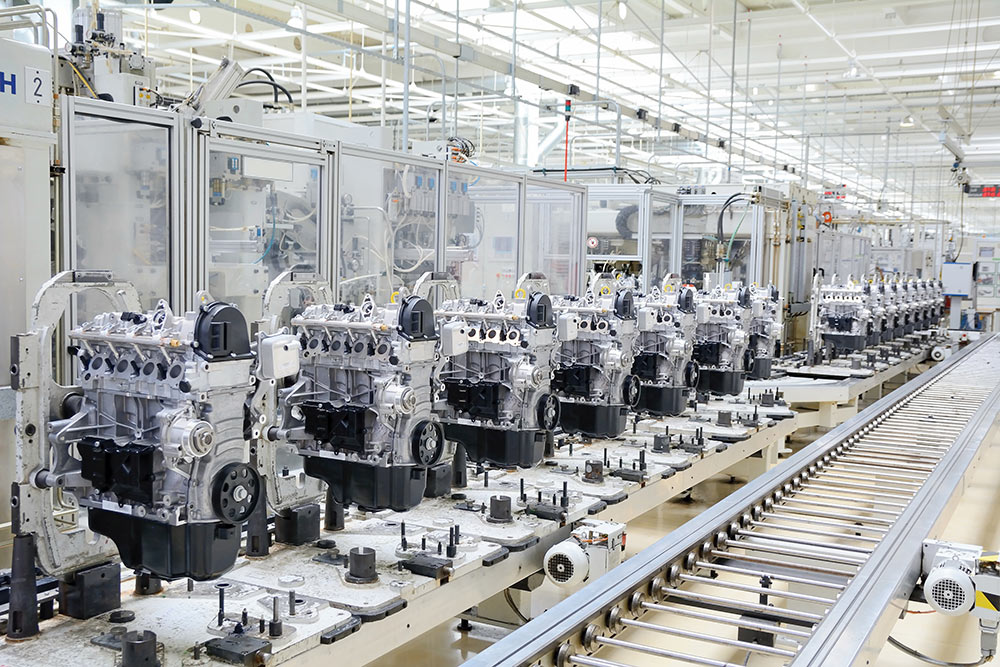

It could be that the processes involved in the manufacture are high risk and need to be properly highlighted and underwritten.

These are just a few factors need to be considered and catered for in a policy.

What’s usually included on a manufacturer or wholesalers insurance policy?

- Buildings

- Business interruption

- Goods in transit

- Plant & Machinery

- Stock including WIP

- Customers goods

- Mechanical & Electrical Breakdown

- Employers’ liability

- Public liability insurance

- Products liability

- Product recall